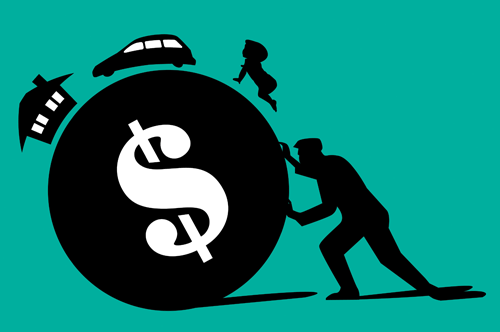

We have all experienced tough financial times at one point in our lives. Being a student, job changes, unemployment, marriage, kids, divorce, health issues, moving, looking after family members in sickness and so forth can all have a negative impact on our finances. The stress of staying afloat during these times can be all consuming but with help and professional guidance, it can become much easier to keep your head above water and turn your financial situation around.

We have all experienced tough financial times at one point in our lives. Being a student, job changes, unemployment, marriage, kids, divorce, health issues, moving, looking after family members in sickness and so forth can all have a negative impact on our finances. The stress of staying afloat during these times can be all consuming but with help and professional guidance, it can become much easier to keep your head above water and turn your financial situation around.

What can you do when you are struggling with debt?

Canadians have some of the highest consumer debt in the world and it is taking a toll not only on their finances but their overall health. If you are one of the many Canadians struggling with increasing debt, it may be time to address the problem.

The first step is to stop creating new debt. In order to better balance family finances, it is important to distinguish between a need and a want. We all need a roof over our head and we all need to maintain a healthy lifestyle. Both work hand in hand and both affect one another. We all need to set some time aside, to evaluate our lives in order to determine what we already have, and what we are still striving to obtain. The truth is, we often do not need more material belongings (stuff) to make us happy. Studies have also shown that people who overspend often do so to compensate for certain shortfalls in their lives. We live in a world where savvy marketing draws people in but the truth is, DO WE REALLY NEED IT?

To assist:

1) Rely on cash at hand

Carrying cash is one way of better managing our money. Seeing how the money actually leaves our hand has a greater impact on us, allowing for greater restraint, than swiping plastic.

2.) Limit credit card use

When properly maintained, one credit card can suffice. The more cards a person has the more their debt-to-servicing ratio is affected. They may not use the full balance of the card, but they have access to greater credit which can be a negative trait from the perspective of lenders. Be very cautious of department store promotional cards. Many people think they benefit from having a 20% discount, but again, they have just increased their debt-to-servicing ratio. There is also an increased temptation to buy more product as a discount is being received, or perhaps there is a no interest period offered. Either of these situations can trap an individual into further debt.

3) Rank debt in order of interest rate

Evaluate all debt and examine which debt is the highest in terms of interest costs. Determine which debts have the highest rates and focus the debt repayment plan around getting those debts paid off first. Also, take some time and research on how to renegotiate interest rates with credit providers. Many banks want to keep clients happily paying their rates but, with a little research and negotiation, it is often easy to find other lenders offering lower rates in order to attract further business.

4) Strategize repayment plans

Starting with a household budget, it is a good idea to evaluate expenditures and see where cuts can be made. Canadians spend a great deal of money on indulgences, such as eating out or vacations. Limiting these indulgences, even temporarily, can have a significant and positive effect on debt repayment. Making minimum payments means a lifetime of debt. We owe it to ourselves not to become tied to large amounts of bad debt. Our money should work for us and not the other way around.

5) Acknowledge progress and do not let setbacks deter moving forward

We should praise ourselves when we are on track. We all make mistakes. The key is to learn from those inevitable mistakes. Things can happen beyond our control and it is, therefore, best to acknowledge that there is no need to stress over things that cannot be controlled. Shift energy into trying to make the best of a bad situation and move on.

If your debt is affecting your ability to keep up with your mortgage payments, please contact us. We have many tools and programs available to help you overcome a variety of debt related issues and help you avoid a home foreclosure.