How do Foreclosures Work In Alberta?

Before you make another move it is important that you educate yourself on the foreclosure process in Alberta, and make the right moves at the right time to stop the foreclosure altogether. There are options to save your home and your credit. Learn everything you need to know about the foreclosure process in Alberta and get professional advice and guidance on your side.

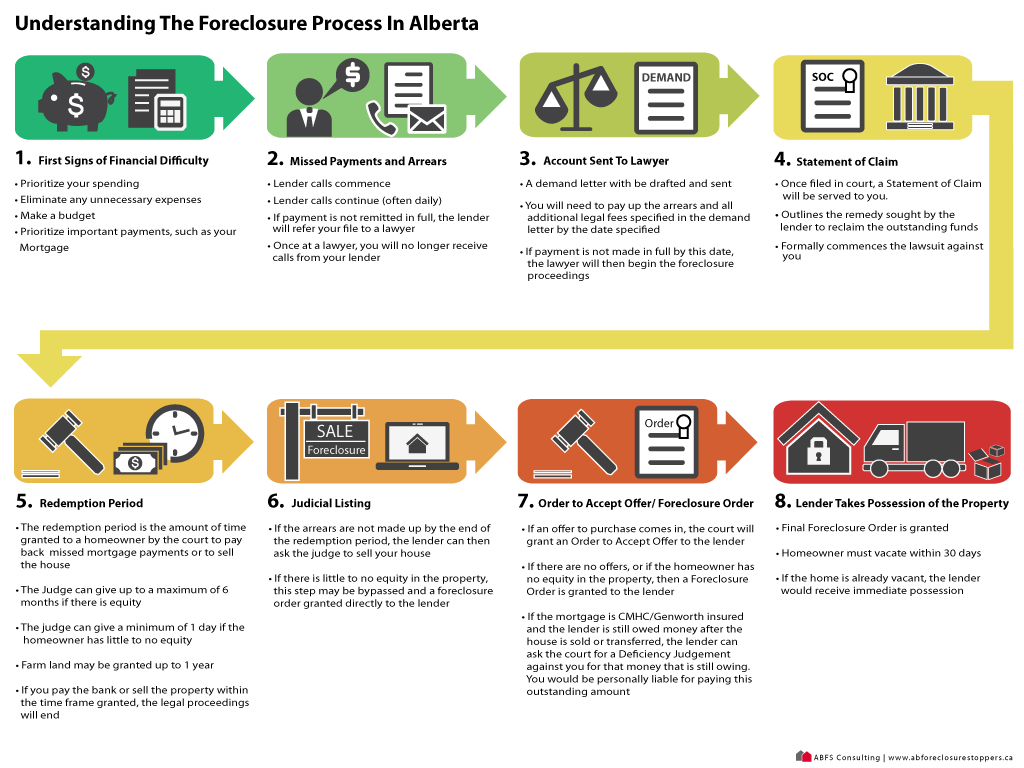

The Alberta Mortgage Foreclosure Process

The first signs of financial difficulty

This first stage occurs even before you begin to miss payments. This is where you begin to experience financial difficulty, and have trouble keeping up with the bills. At this stage, it is important to:

- Prioritize your spending

- Eliminate any unnecessary expenses

- Make a budget

- Prioritize important payments, such as your Mortgage

Missed Payments and Arrears

This is the stage when your mortgage payments begin to get missed. At this stage, you can expect:

- Calls from your lender to begin about the arrears

- If the missed payments are not caught up right away, the bank will send your file over to their lawyer

- Once your file is with the lawyer, you will no longer receive calls from the bank, nor will they accept any payments from you

The Account is Sent to a Foreclosure Lawyer

This is the stage where the bank/lender forwards your file over to a foreclosure lawyer to collect on arrears plus legal fees. At this stage you can expect:

- A demand letter to be drafted by the lawyer and sent to you via email and/or regular post.

- You will need to pay up the arrears plus all additional legal fees as specified in the demand letter by the date specified

- If the payment is not remitted to the lawyer in full by the demand date, the lawyer will begin foreclosure proceedings

The Foreclosure Begins and a Statement of Claim is Sent

At this stage, your lender’s lawyer files a Statement of Claim in court. This step officially begins the foreclosure process. At this stage:

- A Statement of Claim to be served upon you

- The document will include the details of the amount owed to the lender along with the remedy sought by the lender to reclaim the amount owed

- A per diem rate of how much per day you will be charged until the matter is resolved will be stipulated in the document along with the amount owed along with continued accumulation of legal fees

The Redemption Period

The redemption period is the amount of time granted to a homeowner by the court to pay back the arrears or sell the house. At this stage:

- The judge can grant up to a maximum 6 month redemption period if the homeowner has sufficient equity in the property

- Conversely, the judge can also grant a minimum of a 1 day redemption period if the homeowner has little to no equity in the property

- Farmland may be granted up to a 1 year redemption period

- If you pay back all arrears and fees in full during the redemption period, the legal proceedings end

Judicial Listing

If the arrears have not been paid by the end of the redemption period, the court will grant the lender the right to list and sell the property via a Judicial listing. At this stage:

- The lender will have had ordered an appraisal and submitted to the court an Affidavit of Value and Affidavit of Default to determine the judicial listing price

- The lender will be allowed by the court to list the property at the judicial listing price agreed to by the court

- If there is little to no equity in the property, the judge may choose to directly grant an order for foreclosure to the lender

Order to Accept Offer / Foreclosure Order

At this final stage of the foreclosure process, the lender sells off the property, or a foreclosure order is granted. At this Stage:

- If an offer to purchase comes in, the court will grant an Order to Accept Offer to the lender

- If there are no offers, or if the homeowner has no equity in the property, then an Order for Foreclosure is granted to the lender

- If the mortgage is CMHC or Gengrowth insured, and the lender is still owed a balance after the house is transferred, the lender can further ask the court for a Deficiency Judgement against you for the amount still owing.

- If a deficiency judgment is filed against you, you are personally liable for this amount

The above infographic illustrates the step-by-step process that takes place regarding the foreclosure process in Alberta. Please review to get a better understanding of the process and identify at which step your own matter may be at.

Click the image above to view full size.

If you are facing a foreclosure, or have debts that are spiraling out of control, the time to take back control is now. Get trusted professional help through these complex real estate, legal and financial issues that are affecting your home and well being. We have the right people, resources, connections and experience to assist you with saving your home, your credit, and your peace of mind.

Learn more and ask us questions for free by contacting us today!